Insider Trading Lawyer

Insider trading occurs when someone has information that is not available to the public and uses that information to trade securities. Insider trading is a serious offense in most cases because it is considered unfair to investors who do not have the benefit of having the same information. If you or someone you know has been accused of insider trading, an experienced attorney will review your case and discuss your legal options. Contact the insider trading attorneys of Cofer Luster today by calling us at 682-777-3336 or contacting us through our online form.

Who Constitutes An Insider?

Under the Securities Exchange Act, an insider is a person who is directly or indirectly the owner of more than 10% of a company’s equity securities. An insider is also someone who, because of their position, has access to inside information, such as officers, directors, or principal shareholders of a company.

An insider can also include anyone who trades a company’s shares based on material nonpublic information. For example, an attorney of a company with knowledge of an upcoming project that is unknown to the public is not allowed to buy securities using that information. Generally, publicly traded companies only allow employees with access to nonpublic information to trade during specific trading windows.

Federal Insider Trading Laws

Securities Exchange Act

The Securities Exchange Act of 1934 (SEA) governs security transactions on secondary markets to ensure financial transparency and accuracy. All companies listed on a stock exchange must follow the SEA requirements to ensure fair trading and improve investor confidence.

The Securities Exchange Commission (SEC) investigates violations of the SEA, such as:

- Insider trading

- Selling unregistered stocks

- Stealing customer funds

- Manipulating market prices

- Disclosing false financial information

- Breaching broker-customer integrity

Insider Trading Sanctions Act

The Insider Trading Sanctions Act of 1984 allows the SEC to seek penalties from those found guilty of using insider information to trade. In addition to the civil penalties, someone found guilty of insider trading can face severe criminal penalties, including jail time and hefty fines.

Insider Trading and Securities Fraud Enforcement Act

The Insider Trading and Securities Fraud Enforcement Act of 1988 (Insider Trading Act) expands the SEC’s scope to enforce insider trading laws. The Insider Trading Act allows the SEC to impose heavy monetary fines that are usually multiples of the profits generated by insider trading. The cap for monetary fines for insider trading is 300% of the amount of money made or $1 million, whichever is greater.

Stop Trading on Congressional Knowledge Act

The Stop Trading on Congressional Knowledge Act of 2012 (STOCK Act) expanded the reporting requirements for securities transactions by members of Congress. It also clarified that Congress is barred from trading securities using material nonpublic information. In addition, members of Congress and federal officials must make public all securities transactions above the value of $1,000 within 30 days of receiving notice of the transaction and within 45 days of the transaction. Failing to do so violates the STOCK Act.

Under the STOCK Act, all members of Congress and all executive branch employees at and above GS-15 pay are subject to the requirements of the Act. The purpose of the STOCK Act is to ensure that members of the government are not using confidential information not yet made public to profit unfairly.

How To Know If Certain Information Can Be Used To Trade?

Not all information learned through work or tips is considered insider trading. For example, suppose you have expertise in a certain industry and use it to develop trading strategies; that is not considered insider trading.

For someone to be found guilty of insider trading, the SEC must show that the information the defendant used to trade was nonpublic and material to the company. Many publicly traded companies have procedures to identify if the information is confidential and whether the defendant had a duty to keep the information confidential.

For example, suppose someone learns about a confidential project that will not be made public for many years during a board meeting and discusses that information with their significant other. If either the board member or the significant other uses that information to purchase stock right before the project is made public, knowing the stock’s value is going to increase significantly, that can be considered insider trading either directly or indirectly.

Examples Of Insider Trading

There are many high-profile cases of insider trading, such as:

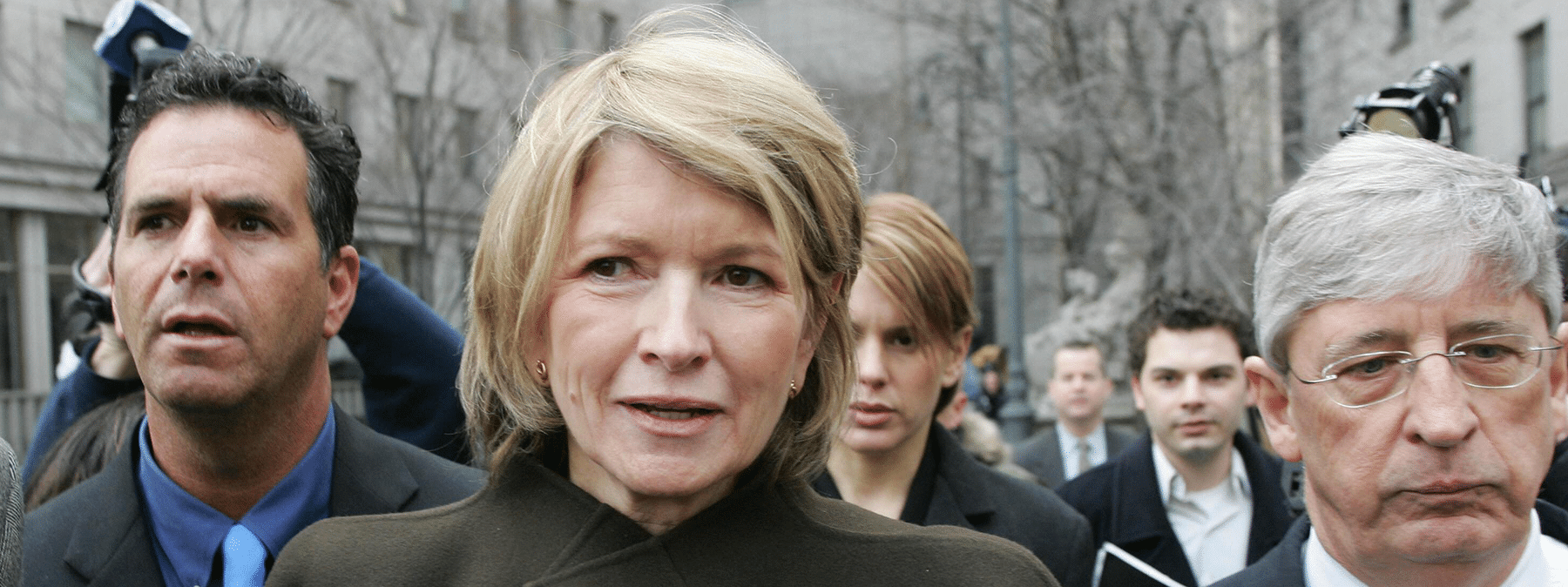

- Martha Stewart: She used her knowledge that the FDA rejected a cancer drug to sell her stock while it was in the $50 range before the information became public. Once the information became public, the shares fell to the $10 range. She was found guilty of insider trading and was required to pay $4.3 million in fines and sentenced to seven years in prison.

- Yoshiaki Murakami: He used nonpublic material information that a company was planning to acquire 5% of a broadcasting company. Using that information, his fund bought two million shares, and he made approximately $25 million.

- Raj Rajaratnam: He used his position as a hedge fund manager to trade inside tips with other traders, hedge funds, and companies to make approximately $60 million. He was found guilty of 14 counts of conspiracy and fraud, resulting in $92.8 million in fines.

Penalties For Insider Trading

Under federal law, anyone guilty of insider trading can face up to 20 years in prison and fines of up to $5 million. In addition, businesses that are found guilty of insider trading may be fined up to $25 million. In addition to sentencing and fines, the guilty party may be required to pay restitution to the monetarily damaged individuals because of insider trading.

Contact An Experienced Insider Trading Criminal Defense Attorney

The attorneys of Cofer Luster are experienced white-collar defense attorneys who will review the facts of your case and develop a strategy to defend you against criminal charges. Contact a Cofer Luster insider trading lawyer today for a confidential consultation by calling us at 682-777-3336 or contacting us through our online form.